Cost optimisation: understanding the drivers of cost pressure

Businesses are facing increasingly turbulent conditions, with geo-political, economic and supply chain issues leading to operational and financial challenges.

Consequently, business leaders are under increasing pressure to deliver near-term cost reductions and attempt to respond without the full picture.

Effective cost optimisation starts with understanding the external and internal drivers that are specific to your circumstances. This will determine the nature of the problem you are trying to solve, whether near-term and one-off, or ongoing and enduring, and help you decide which cost reduction strategy to pursue.

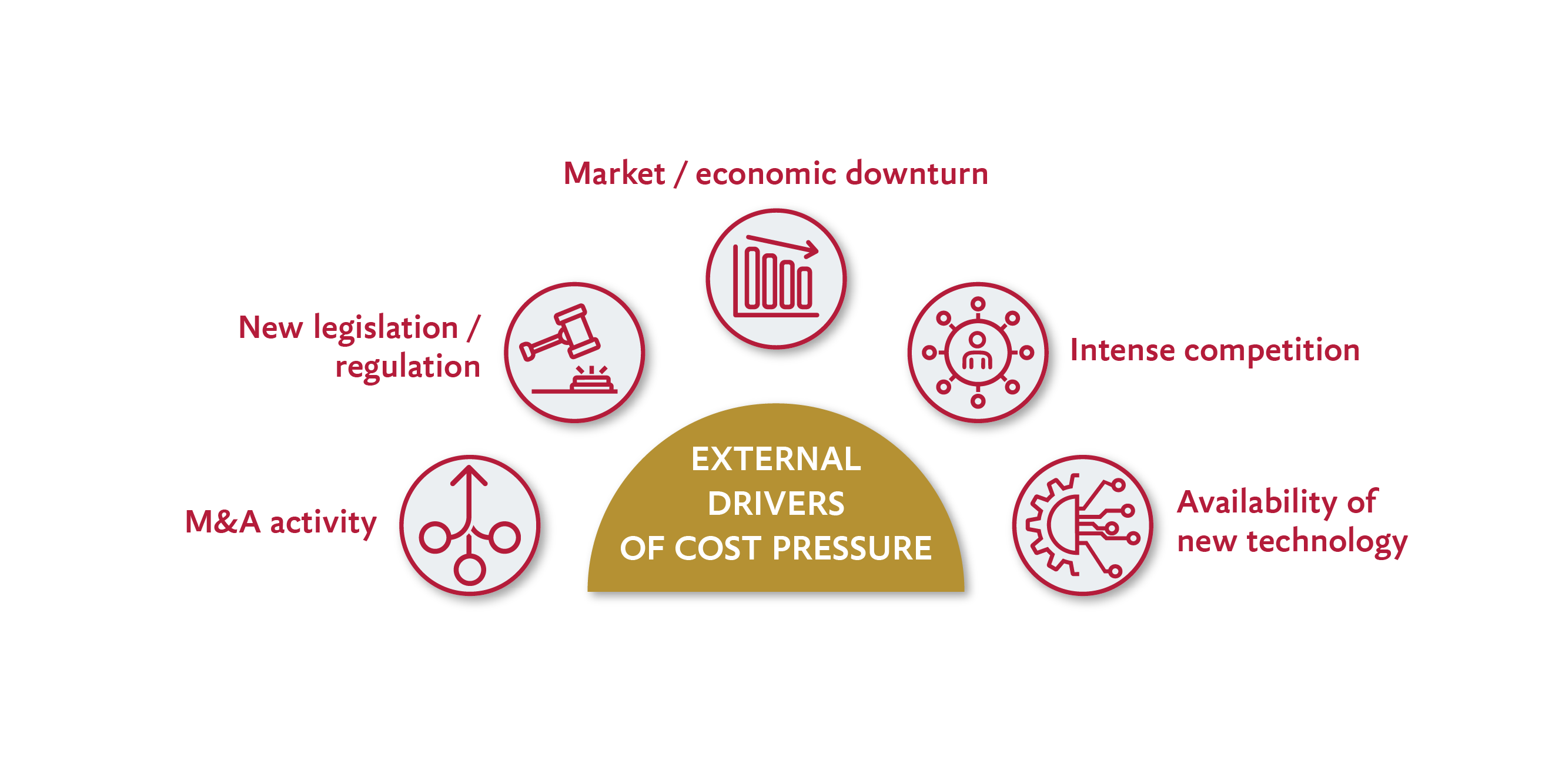

External cost drivers

Learn more about these common external cost drivers, along with typical trends in each area.

Volatile M&A activity drives investors to target deeper and faster structural change to realise the value of their assets.

Evolving ESG regulation will increase cost burdens on businesses to avoid non-compliance penalties.

Evolving regulation and disclosure requirements (in areas such as ESG, financial control and employee relations) can increase effort and cost which may lead to offsetting considerations to maintain margins.

The high cost of money is impacting growth plans, investment ambition and margins.

Global supply chain challenges can increase input costs, with knock-on impacts on pricing and demand

Competition e.g. from new entrants and innovative players, coupled with higher borrowing and input costs, contributes to margin pressure.

New technology, such as generative artificial intelligence (AI) offers potentially game-changing opportunities for businesses to reevaluate their cost bases.

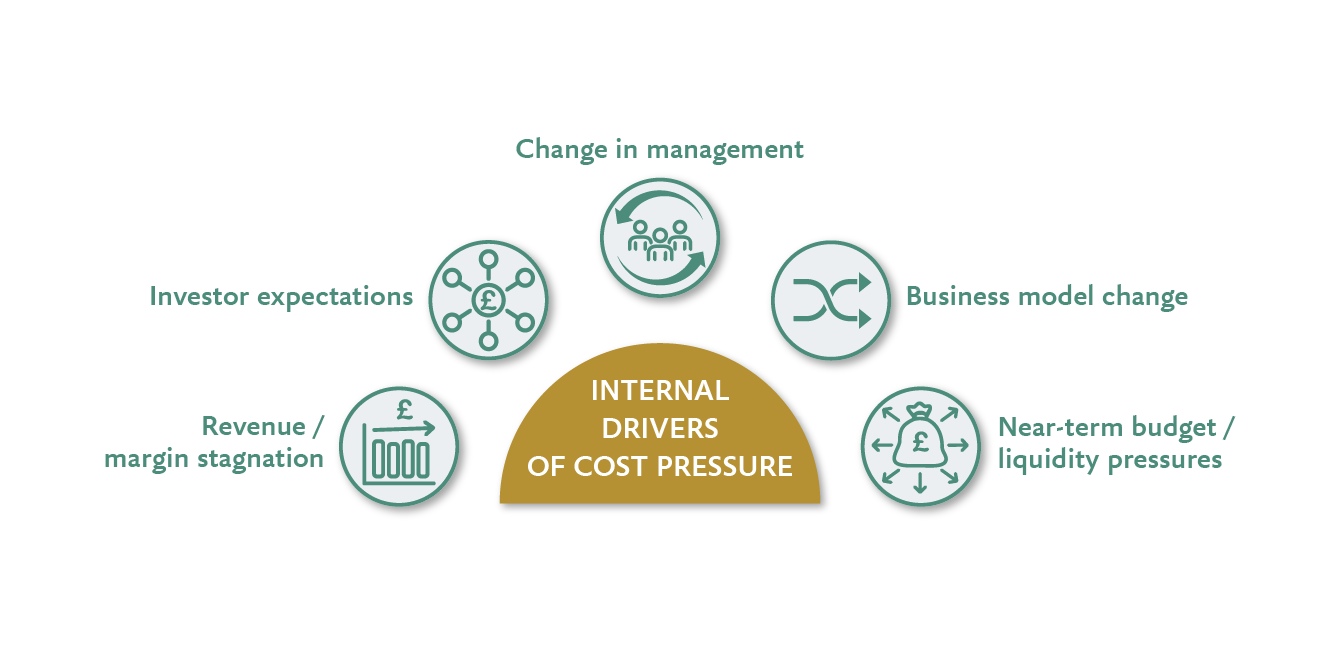

Internal cost drivers

Learn more about these common internal cost drivers, along with typical trends in each area.

Mature businesses often see margins stagnate as demand plateaus while fixed costs continue to creep up.

Legacy costs and baked-in budget rises can drag on margin and prove difficult to shift.

There are increasingly more institutional investors seeking to unlock untapped value. This is doubly so for businesses without clear strategies, offering activist investors opportunities to generate value through robust cost management.

Market and trading conditions can change unexpectedly. Businesses may need to make near-term cost choices to align with profit expectations and guidance they previously provided to investors.

New leaders, or changes in management teams, often look to drive rapid change to mark a change in direction.

This trend will likely be particularly pronounced in a high interest rate environment.

New technologies and markets can change how businesses leverage resources and transactions to create value.

Those able to pivot quickly and capitalise on change can see significant margin gains. Businesses unable to do so may struggle to maintain competitiveness, requiring rapid cost reduction and restructuring to remain viable.

A combination of sudden adverse market or economic movements, mismanagement or unanticipated one-off events may result in short-term cost and cash pressures.

Successfully responding to these challenges requires a balance of near-term cost avoidance and longer-term structural change to address underlying challenges.

How to respond to cost pressure

Many businesses are under pressure to act quickly to deliver short-term savings, but they need to assess the relevant cost drivers to determine how to react appropriately.

The post-pandemic slowdown coupled with a high inflationary environment is putting significant stress on businesses. Within many organisations, rising operating and borrowing costs, together with new technologies and intense competition, will require a disciplined cost mindset.

Understanding these drivers and how they impact your organisation specifically can help you gain clarity over the problem you are trying to solve, and potentially identify the level of savings you need to achieve and the timeframe required. This will help you to make informed decisions on your course of action.

There is no one-size-fits-all ‘right’ answer and choosing a path forward depends on the outcomes you need to achieve and the trade-offs you’re willing to accept.

How can you respond to cost pressure?

Your response will typically include a combination of cost avoidance, cost reduction and cost base optimisation.

Cost avoidance involves deferring or cancelling controllable spend in the near term. It would typically be appropriate when undertaken in reaction to an unexpected event or materially adverse underperformance.

Cost reduction efforts typically focus on identifying and eliminating activities that generate limited or no value to enhance budgets. They are usually undertaken to address medium-term cost pressure.

Cost base optimisation involves evaluating which activities to undertake and how they are performed across the entire organisation. Such programmes require long-term, structural change and so typically form part of a strategic transformation.

In Part 2, we’ll explore these different responses in more detail so we can understand the different options available, their potential and their limitations.