Insight

Under the spotlight: Gearing up for ESRS

The European Sustainability Reporting Standards (ESRS) – the disclosures required under the EU’s Corporate Sustainability Reporting Directive (CSRD) – are going live – for some businesses as soon as 2025. The ESRS will put businesses’ environmental, social and governance (ESG) record under an auditable, comparable and potentially harsh spotlight. But many companies are unaware or unprepared, especially if they’re based outside the EU. So, what does ESRS involve, what’s at stake and how can your business get preparations underway in a systematic and efficient way?

Think about how much care and effort goes into your financial reporting. And how much is at stake – from how your company is valued to the reputational risks of re-statement. Then imagine if the same detail, peer group comparability and need for ‘investor-grade’ reliability are applied to non-financial sustainability reporting. This, in a nutshell, is ESRS.

Big leap

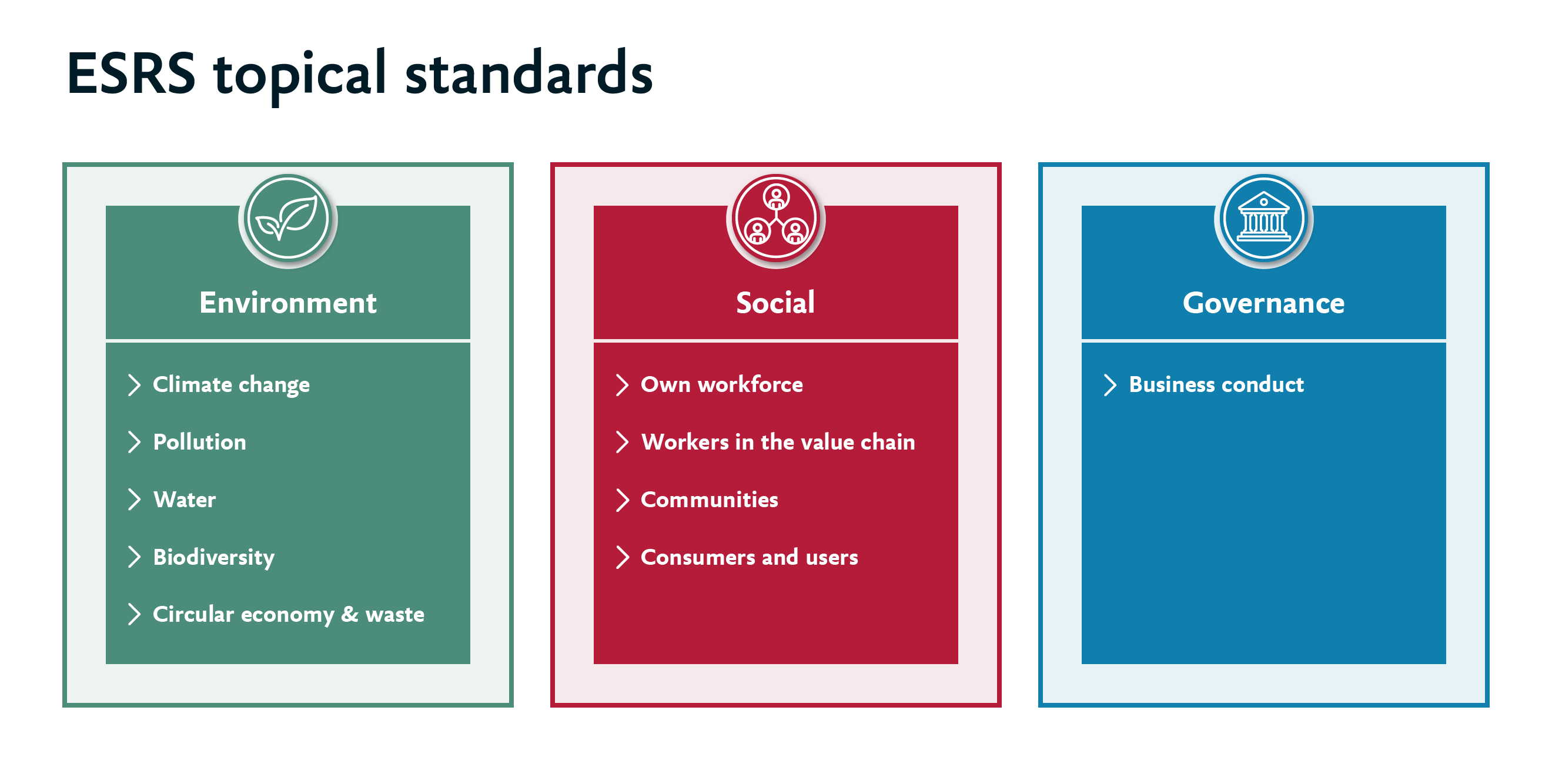

The ESRS reporting framework requires you to first consider what your material impacts are (through a ‘double materiality assessment’). You then need to disclose information on these impacts, including impacts in areas like climate change, the circular economy and pollution, not just in your own operations and products, but across your value chain. We consider how to perform an ESRS ‘double materiality’ assessment in this article.

ESRS also looks beyond environmental impacts at your social impact on workers in your value chain, local communities and consumers and end-users. It additionally asks you to consider corporate governance practices around issues like anti-bribery and anti-corruption.

Scale of the task

If we look at the implications, the first big challenge is the sheer scale of the task. ESRS requires a huge amount of information gathering, measurement and validated assurance – around 1,000 data points at the latest count – many of which will be new and touch every aspect of your business from operations and IT to HR, finance and procurement.

Increased scrutiny

The other big consideration is what ESRS says about your company and how you’ll be judged. Both the depth and breadth of the disclosures open up your strategy and performance on ESG to a new level of scrutiny and comparison. And the people applying this scrutiny won’t just be regulators, but also investors, consumers and employees.

Sustainability reporting might have been a 'side-desk' or a chance to deliver selective messages before. Now it’s at the core of investor relations and wider communications on a par with financial reporting and needs to be accurate and comprehensive.

As a result, there will be a lot more focus on how to avoid being called out for ‘greenwashing’. Just as damaging could be ‘greenhushing’ – avoiding unfavourable disclosures. But far from simply thinking of ESRS as an arduous and potentially risky headache, this is an opportunity to tell your ‘ESG story’ and shape perceptions of your business. In turn, the data can help your business to ‘do the right thing’, including where you need to reshape business practices or address areas in need of improvement.

Are you in scope and, if so, when?

So the first questions you’re likely to be asking are whether my business is in scope and, if so, when do I need to be ready to report?

The threshold is actually quite low, covering most multinational enterprises (MNEs) with any two of the following; a balance sheet of more than €20 million, net turnover of more than €50 million and an average of more than 250 employees in the financial year.

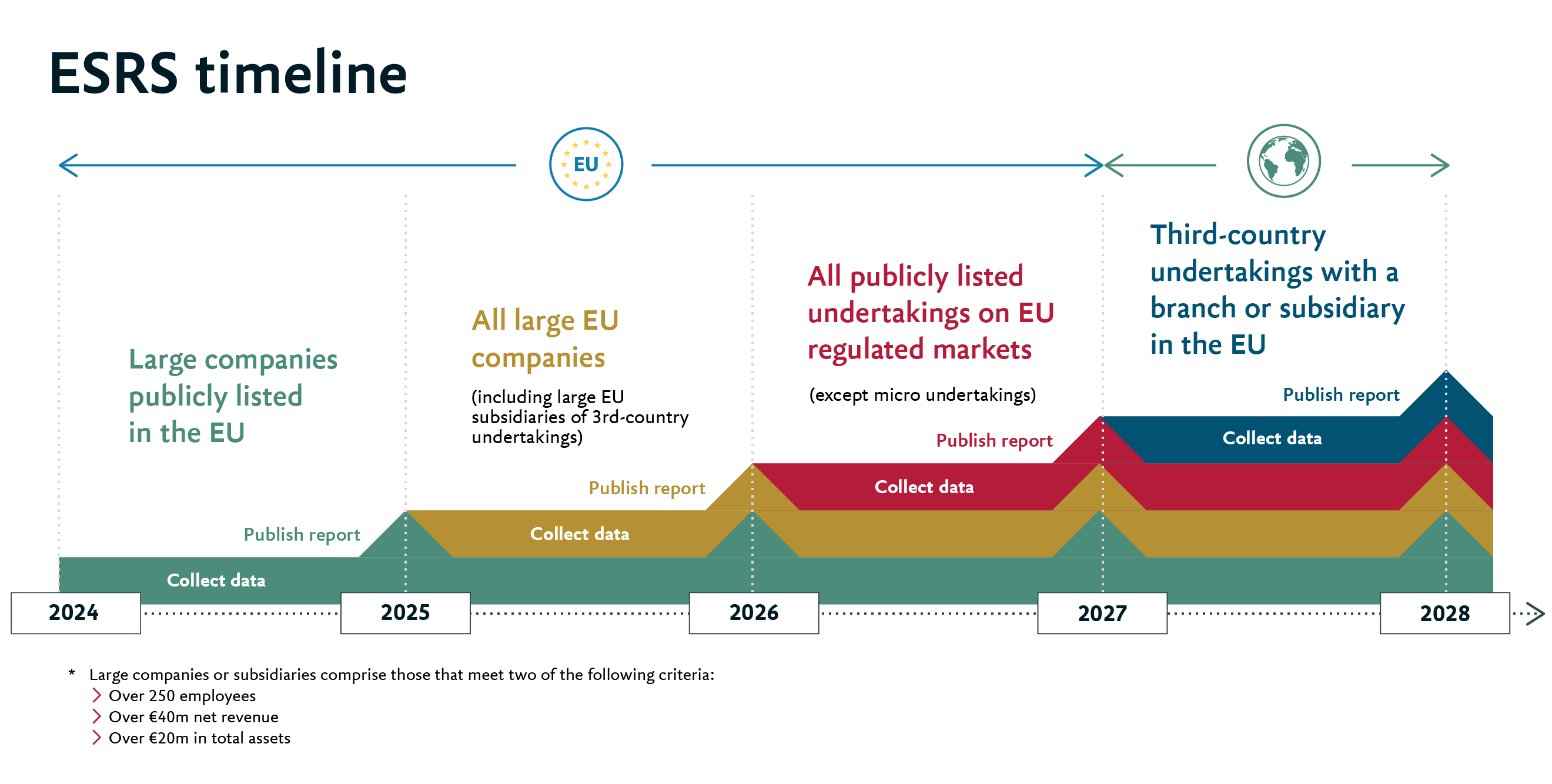

If you are a large company already subject to NFRD you’ll have to start reporting in 2025 on 2024 data. If you have listings or subsidiaries in the EU, you’ll need to begin reporting in 2026 on 2025 data as a large company and 2027 on 2026 data as a small and medium-size enterprise (SME).

If you’re a UK, US or other non-EU company with significant undertakings in the EU, the reporting deadline is 2029 on 2028 data. We often find that these non-EU companies are less aware or prepared than their EU-based counterparts as there has been less publicity outside the bloc. Even if companies know about ESRS, many are unclear about how the requirements dovetail with and differ from local standards such as UK Taskforce on Climate-related Financial Disclosures (TCFD) or US Securities and Exchange Commission (SEC) climate risk disclosures.

Moreover, even if your business isn’t within the ESRS scope yet, this is going to be the “gold standard” for sustainability reporting and so other reporting requirements are likely to follow or align with it in time.

Ready to go

So how can you get started? There is still sufficient time to get your business up to speed, especially if you’re due to file your first report in the coming years. But it’s important to begin scoping and initial mobilisation as soon as possible as there are important decisions to be made at the outset, foundations to be laid within your organisation and need for engagement with suppliers and other partners. Five foundational steps stand out:

Assess the most material sustainability impacts and financial risks and opportunities across your value chain and prioritise these as you get started.

Identifying your material impacts early can help focus the scope of your reporting. Moreover, it will allow sufficient time for information gathering and measurement, and give you time to make the operational adjustments or interventions needed to tackle the risks ahead of public disclosure. We consider how to perform an ESRS ‘double materiality’ assessment in this article.

With the material impacts identified, you can begin to assess the information required and the gaps to be bridged.

Some of the required metrics may already be accessible from existing sustainability reporting. But most won’t. The challenges are heightened by the extended reporting boundaries and reporting period of ESRS reporting.

Alongside the information demands, it’s also important to assess the system capabilities you’ll need and what upgrades may be necessary. This includes the tools to capture, analyse and validate vast new amounts of data.

Establish clear lines of verification, accountability and governance over both new input data and previously undisclosed lines of reporting. Key priorities include a balance between centralised control of data and assurance on the one hand and business-led ownership and accountability for each data point on the other.

Establish when your business needs to comply and whether less detailed interim requirements will apply. In particular, some SMEs may be allowed more time to prepare. How the criteria are applied depends on the size and nature of your business.

Appoint a senior business leader/sponsor to help underline the strategic importance of ESRS and mobilise your organisation and actors in the wider value chain to deliver a high-quality report.

Leadership from the top will help to secure sufficient resources and resolve potential delays and roadblocks along the way. Without this senior sponsorship, your business could see ESRS as a low priority or side-desk concern.

Set up to deliver

With these foundational steps in place, you can make an informed decision about your strategic ambitions – whether you want to focus solely on compliance, use ESRS as a catalyst to embed sustainability as a principle across the organisation or follow a tactical approach in between – we explore the choice of approach in our article 'ESG and sustainability: What information should you monitor and report'.