Insight

The cheat sheet guide to ESG and sustainability reporting

Are you confused by the complexity around ESG and sustainability reporting requirements? Struggling to tell the difference between guidance and frameworks?

There’s a myriad of global guidance, regulation and reporting frameworks, which will apply to different organisations depending on size, industry and specific market or regions. It’s understandable that many leaders feel bewildered.

If you’re seeking to understand which requirements apply to your organisation and how to best meet them, follow our cheat sheet guide to get started.

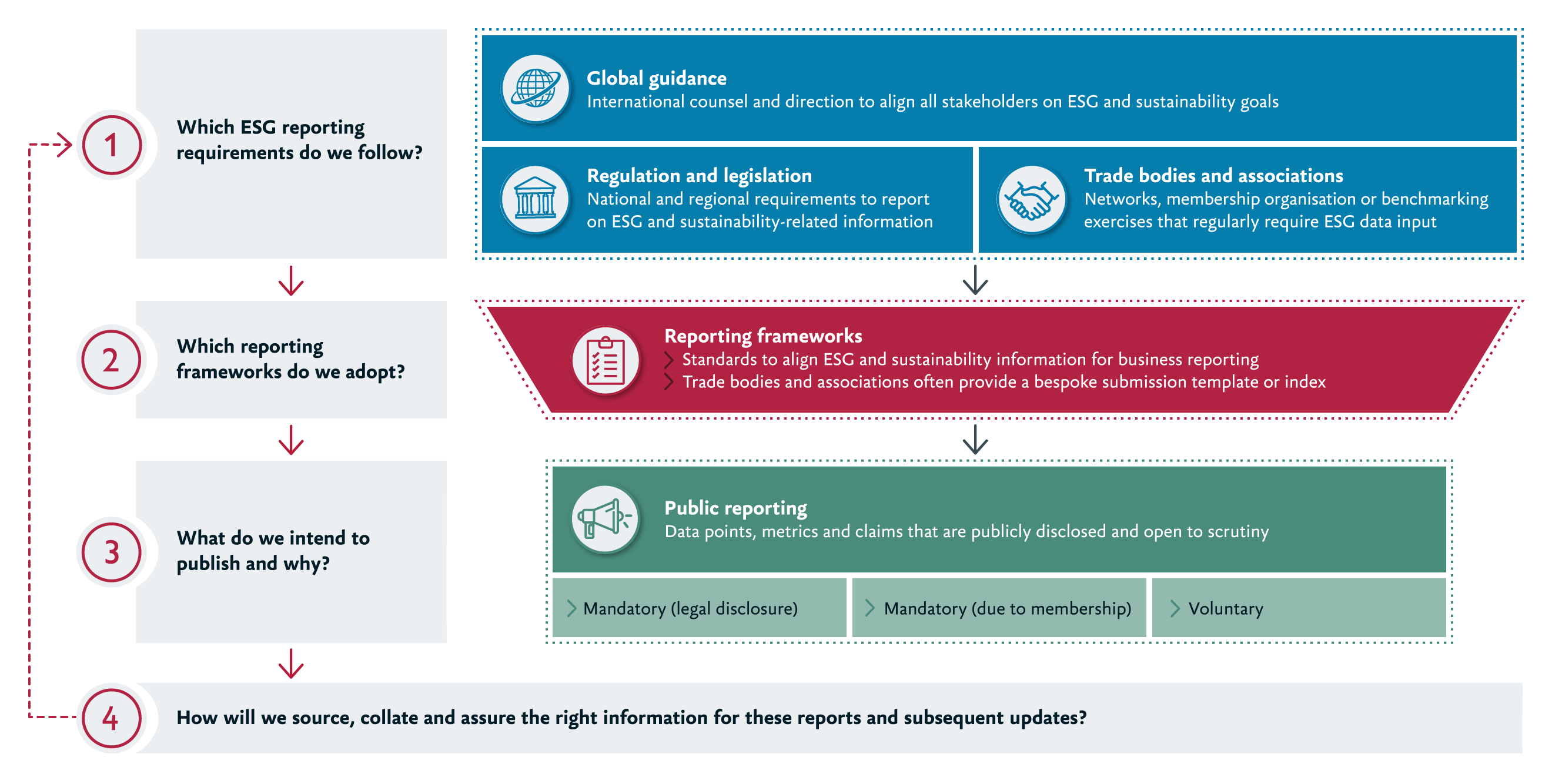

In our view, the right approach to ESG and sustainability reporting involves four key stages. At each stage, all organisations need to answer a fundamental question.

1. Which ESG and sustainability reporting requirements do we follow?

Broadly speaking, when assessing which ESG and sustainability reporting requirements apply to your specific organisation, there are three main categories that you will need to consider.

Global guidance is issued by international bodies to provide counsel and direction, aligning all stakeholders on ESG and sustainability goals.

Prominent examples of global guidance include:

The United Nations (UN) has outlined 17 Sustainable Development Goals (SDGs) which help focus a global audience on what the inter-governmental body regards as the most critical global issues. Each SDG has a set of specific targets and indicators.

Audience

All stakeholders

Focus

ESG, including double materiality i.e. how an organisation impacts society and/or the environment and how ESG factors impact the organisation’s financial or operational performance.

Outcome

Public awareness and engagement

A global call to organisations to align business strategy and operations with a set of principles that contribute to societal goals and outcomes, including UN SDGs.

Audience

All stakeholders

Focus

ESG, including double materiality

Outcome

Organisational adoption

Regulation and legislation are issued at national and/or regional level, which mandates reporting on key ESG and sustainability-related information.

Examples of significant regulation and legislation include:

The Corporate Sustainability Reporting Directive (CSRD) is an EU regulation, which aims to broaden the existing Non-Financial Reporting Directives (NFRD). CSRD is intended to help investors, civil society organisations, consumers and other stakeholders evaluate the sustainability performance of companies, as part of the European green deal.

Audience

All stakeholders

Focus

ESG

Outcome

External report

The Sustainable Finance Disclosure Regulation (SFDR) aims to improve transparency in the EU market for sustainable investment products, to prevent 'greenwashing' and to increase transparency around sustainability claims made by financial market participants.

Audience

All stakeholders

Focus

ESG, including double materiality

Outcome

External report

This globally leading piece of legislation sets out a range of measures on how to deal with modern slavery and human trafficking within the UK. If UK companies meet certain criteria, they must publish a Modern Slavery statement annually.

Audience

All stakeholders

Focus

Social

Outcome

External report (statement)

In the UK, Extended Producer Responsibility (EPR) aims to make producers responsible for the cost of collecting, managing and recycling packaging and incentivise them to make their products recyclable by modulating fees based on the recyclability of products. It also aims to reduce unnecessary packaging, increase quality and reduce litter.

Audience

All stakeholders

Focus

Environmental

Outcome

External report

Trade bodies and associations may require reporting on ESG and sustainability data as part of their membership requirements.

Examples include:

B Lab, a global nonprofit network, offers B Corporation (Corp) Certification to companies which meet high standards of social and environmental performance, transparency, and accountability. To gain the B Corp designation, companies must submit to B Lab’s verification process, with recertification required every three years.

Audience

All stakeholders

Focus

Environmental

Outcome

Assessment and accreditation

The Ethical Trade Initiative (ETI) is a leading alliance of trade unions, non-governmental organisations (NGOs) and companies, working together with key stakeholders to promote practical solutions to end the abuse of human rights at work.

Audience

All stakeholders

Focus

Social

Outcome

Assessment and accreditation

2. Which ESG and sustainability reporting frameworks do we adopt?

A reporting framework provides a set of standards to help you structure and report your ESG and sustainability information.

At present, there is no universally recognised reporting standard for ESG and sustainability, unlike in other areas such as financial reporting.

Instead, there are many to consider, with varying degrees of overlap. Some are linked to specific regulation or legislation and are designed to help organisations meet those specific mandates.

Examples include:

EU Sustainability Reporting Standards (ESRS) outline the mandatory concepts and principles to which companies reporting under the Corporate Sustainability Reporting Directive (CSRD) must align their sustainability statements.

Audience

All stakeholders

Focus

ESG, including double materiality

Outcome

External report

The EU Taxonomy provides a minimum standard across sustainability disclosure requirements, effectively creating a green investment rule book that specifies which investments can be considered sustainable.

Audience

All stakeholders, but focused on investors

Focus

ESG

Outcome

External report

The Task Force on Climate Related Financial Disclosures (TCFD) provides guidance for organisations on what information and risks they should communicate in relation to climate-related financial disclosures.

Audience

Investors and financial institutions

Focus

Environmental and governance (single materiality)

Outcome

External report

The Sustainability Accounting Standards Board (SASB) uses a combination of global- and industry-specific standards to identify ESG opportunities and risks most relevant to the financial performance of a specific industry. SASB standards are now under the oversight of the International Sustainability Standards Board (ISSB), as part of the International Financial Reporting Standards (IFRS) Foundation.

Audience

All stakeholders, but focused on investors

Focus

ESG, including double materiality

Outcome

External report

Where trade bodies and associations request ESG and sustainability reporting, they will often provide a bespoke submission template or index.

Organisations will need to assess which reporting framework/s will best help them meet the requirements that apply to them specifically.

3. What ESG and sustainability-related information do we intend to publish and why?

Publicly disclosing your ESG and sustainability-related information involves publishing data points, metrics and claims, and opening them to potential scrutiny.

Some public disclosures will be mandatory, either due to legal regulation or trade body or association membership. Others will be voluntary and should be considered, depending on the benefits or opportunities they could unlock.

Each organisation will have specific circumstances and priorities, which will determine their level of public reporting. Making this assessment should also include examining the ongoing time and resource required to understand reporting requirements, make informed decisions on how to proceed, and meet these commitments reasonably and efficiently.

4. How will we manage and maintain the right information for ESG and sustainability reports?

Once you’ve determined the right level of public reporting, you will need to ensure the organisation can manage the information required. This will include sourcing, collating and assuring the right information, as well as maintaining your reports over time.

To do this well, you’ll need to look at your processes, your people and the technology you employ. You may find that changes need to be made, and many organisations will need to undergo significant transformation to build an effective ESG and sustainability reporting capability.

How to ensure your ESG and sustainability reporting remains current

This four-stage approach should help you gain greater clarity over your ESG and sustainability reporting. However, it’s important to note that this is not always a straightforward linear process, nor is it a one-and-done exercise. ESG and sustainability reporting is a changing landscape and organisations will need to continue monitoring both regulatory changes and any new benefits that reporting could help unlock.

By regularly revisiting our recommended key questions, you can ensure you keep ahead of new developments, assess what applies to your organisation, and make the right, strategic decisions.