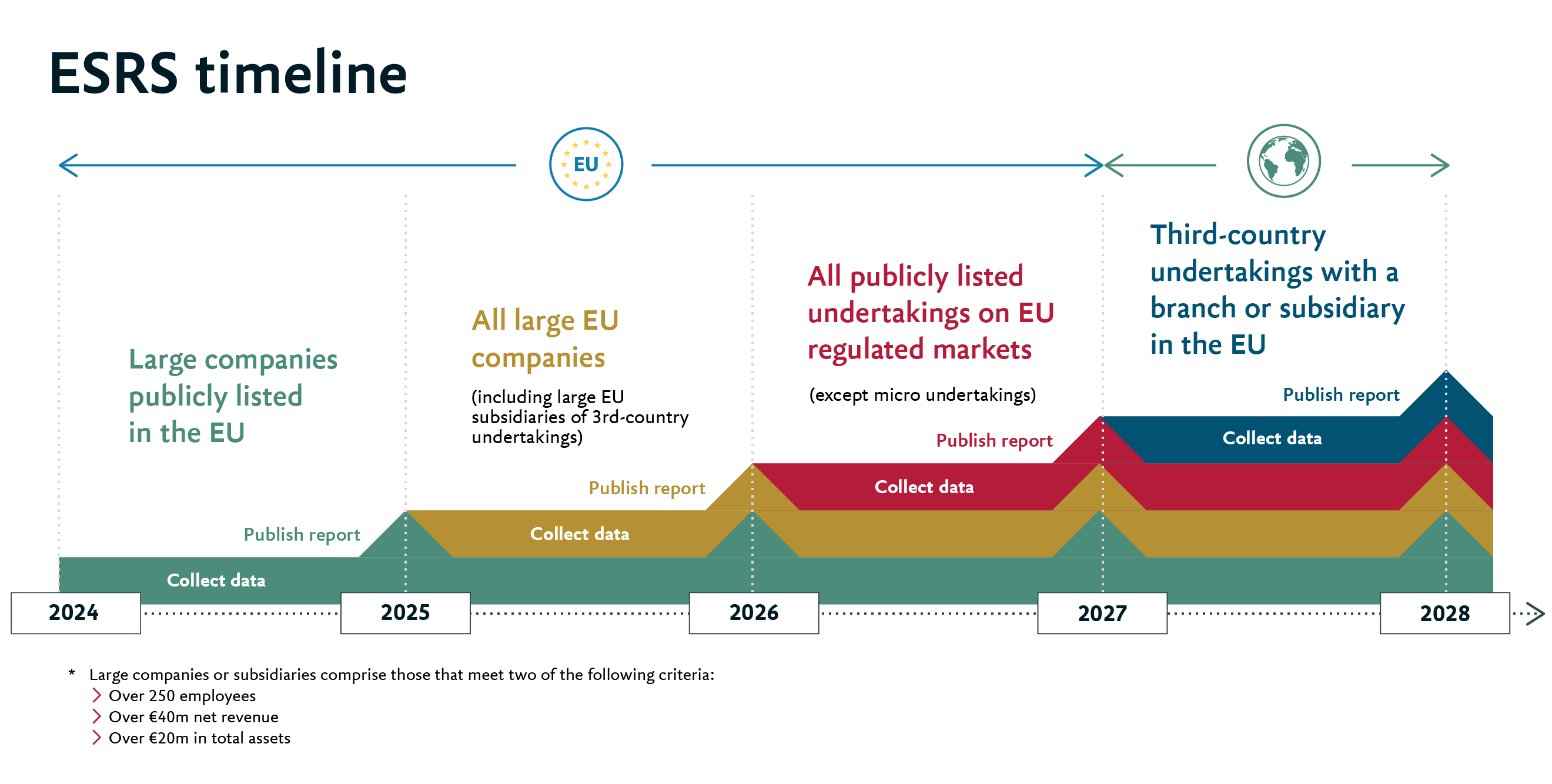

By now most US-based businesses, especially those operating globally, have heard of the European Sustainability Reporting Standards (ESRS) – the new disclosures required under the EU’s Corporate Sustainability Reporting Directive (CSRD). What might they mean for your company?

Your US-based business could well fall into the ESRS scope if your operations qualify as a “significant undertaking” in the EU—having an EU subsidiary, or generating a certain threshold of revenue, for example. Even without these criteria though, companies that maintain any form of regulatory reporting must take note that the ESRS is emerging as the global standard for environmental, social and governance (ESG) reporting. Preparing for ESRS means readying your business for reporting requirements likely to emerge across markets over time.

So, if ESRS matters, what does it entail and how can your business prepare?

This year, the SEC climate rule formalised climate risk reporting requirements for a broad set of organisations, elevating the role of ESG on US companies’ strategic agendas. Many of these companies also adjusted reporting under the SEC’s 2023 enhanced human capital disclosures, and continue to manage a patchwork of state-level ESG requirements.

Given an already complex landscape, incorporating ESRS considerations into reporting may seem like an unnecessary step. However, both regulatory and consumer trends indicate a growing focus on ESG, and the comprehensive nature of the ESRS makes it an impactful tool to guide reporting strategy in several ways:

- Bringing ESG vision to life: laying the groundwork for ESRS compatibility now can help companies build long-term ESG capability. As a comprehensive ESG framework, the ESRS encourages an integrated approach to reporting that will help companies align internally on ESG strategy.

- Comprehensive insights: investing in ESRS-compliant capability can give companies better insight into how ESG strategy is performing across operations, and prepare for future risk mitigation.

- Setting and maintaining a competitive edge: using ESRS principles to inform reporting and operational changes helps US-based companies compete with EU peers who already comply with the regulation. It can also give US-based organisations an edge with global consumers and investors, as transparent risk assessments and commitment on ESG increasingly create a competitive advantage across global markets.

An opportunity for greater impact

So how does ESRS differ from your current disclosures? While the SEC climate rule established a clear connection between climate risk and financial risk, the ESRS framework extends this conversation, using a ‘double materiality’ approach. Double materiality applies the concepts of both material risk and impact to include your company’s “inside-out” influence on society and the environment, not just the “outside-in” impact of these elements on a company’s internal operations.

This means that efficiently and accurately reporting on a double materiality basis requires disclosure of external impacts, such as the asset exposure to climate-driven risk like fires or floods, and internal impacts like levels of natural resources use. For a typical company, this can comprise concepts including labour conditions, workforce diversity, and manufacturing decisions, and could require sourcing up to a thousand distinct data points from across multiple geographies and functions.

Though the execution is complex, using the ESRS framework provides an immense and timely opportunity for US companies tell an accurate, future-focused ESG story. It also helps organisations to reimagine what “good” looks like for ESG strategy, and consider reshaping business practices or addressing areas in need of improvement.

Looking ahead

So how can you incorporate ESRS considerations into existing ESG reporting activity? Four foundational steps stand out:

ESRS is one of several ESG disclosures with the common aim of making strategy and performance more transparent and comparable across companies to help investors and consumers make informed decisions. Given the breadth of impact that these considerations have, formalizing governance and accountability at the highest levels is a priority.

Companies reporting under the SEC climate rule will have established board-level oversight of some sustainability standards - now it's time to extend this to a wider range of ESG considerations. Similarly, leaders who own enterprise ESG decisions - often those in a central sustainability or finance function - can increase alignment on data management and processes that provide insight into the double-materiality impacts of an organization.

Getting these levels of accountability right is the most important part of integrating ESRS thinking into enterprise reporting.

With leaders aligned and governance in place, data owners must be empowered to source and analyse inputs to material impacts.

A double materiality framework necessitates pulling information from a broader set of sources than many US-based organizations have or perhaps currently do. Making sure this happens efficiently means ensuring that data owners and program managers can work together as appropriate decision makers, through the enablement channels that leaders establish through centralized governance.

The good news is, organizations that have prepared for SEC climate rule or other state regulations have already done the difficult work of establishing cross-functional data sourcing teams.

Companies reporting under the SEC climate rule or other state regulations may have access to Scope 1-3 emissions data, for example. To build on this, organizations can pilot the process of identifying an expanded set of data points to understand the insights and capabilities needed to respond to a comprehensive set of ESG reporting needs.

Assessing "inside-out" and "outside-in" ESG impacts can strengthen community and customer relations and reduce reputational risk by deepening your understanding of what matters most to your stakeholders. Establishing this understanding will offer you rich material insights into their wants and needs, and working to close gaps will be important.

Identifying material impacts early can help focus the scope of reporting. It will also allow sufficient time for information gathering and measurement, along with operational adjustments or interventions to tackle risks ahead of public disclosure. You can facilitate this process by ensuring ESG talent can access assurance providers and expertise to understand and proactively address your most pressing needs.

Working towards a double-materiality framework will support your long-term sustainability strategy, but will also require both operational and mindset shifts across your organization.

Recognize that upskilling will be needed as teams incorporate new material insights from stakeholders into their work. Commercial teams can update interactions with customers as organizational value propositions shift, and support functions can lead enablement, training, and the building of a reinvigorated ESG message in the market.

Integrated reporting using the ESRS framework can establish a basis for broader transformation. Taking on an enterprise enablement mindset supported by continuous learning, updated delivery models, and ways of working will help.

Let’s talk

We are currently helping several organisations prepare for ESRS reporting requirements. Get in touch to learn more about how to best incorporate the global standard for ESG reporting into your company strategy.