Every year consumer packaged goods (CPG) organizations spend huge sums on trade spend (TTS, or Trade Terms Spend), with some statistics putting this figure at over 20% of total revenue. Trade spend describes the money that CPGs pay to their customers, the retailers, to incentivize them to increase consumer demand for their products. Most of this amount relates to promotional activities.

Unfortunately, there are several factors already eroding CPGs power in customer negotiations that are likely to increase this percentage in the future. These include new channels dominated by highly competitive customers such as internet retailers and discounters, and pressure now being exerted by some traditional customers combining their bargaining power into buying groups.

However, the outlook is not all doom and gloom; there are several strategies that CPG organizations can adopt to either combat or even exploit these evolving market conditions. These include implementing net revenue management (see our separate article ‘Secure Good Growth with Net Revenue Management’) and investing in modern technology and analytics tooling to provide real insight to optimize trade spend.

In this article, we discuss how CPG organizations can use technology to help optimize their trade spend and the factors that need to be considered to ensure that such tooling is implemented effectively.”

Technology as an enabler for growth

‘Digital’ is a buzzword for the CPG sector, as it is for many others. Many CPG organizations are asking the question of what ‘digital’ means for them and specifically, how it can be used to improve their sales capabilities across all areas (such as category management, retail execution, customer planning and, perhaps most importantly, trade promotions management).

Many CPGs struggle to decide where and how to invest in the ‘building blocks’ of this landscape, and in what order. The sales capability tooling choices available include category management tooling that provides data driven store and shelf analysis, and retail execution tooling that provides the field force with mobile driven data to optimize in-store sales and merchandising.

However, CPGs' primary focus is often on the promotions management area, and here the tooling choices break down further:

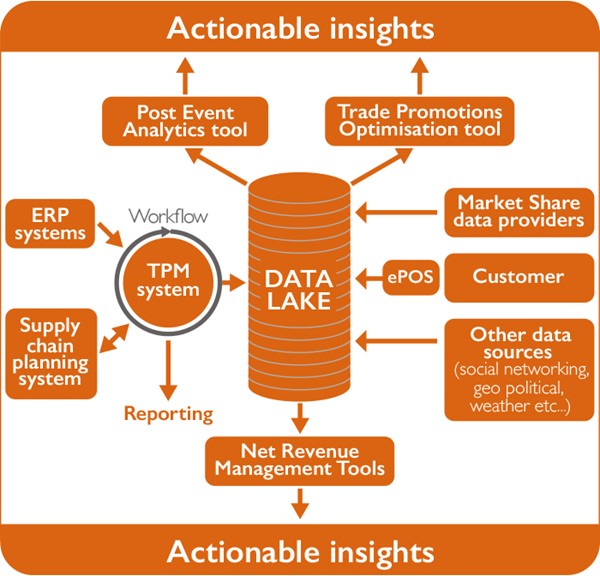

TPM act as the system of record for promotions and can drive greater visibility and efficiency in the promotion planning process. They can also potentially help to facilitate joint business planning with customers. These applications ingest data directly from finance, sales and supply chain planning systems and automate the complex calculations required to build a promotion plan helping to ensure accuracy and transparency. They also provide the data labelling rigor required to enable analytics tooling.

PEA tools use TPM and market share data to assess the effectiveness of promotions. These provide the capability to look back and work out, with hindsight, which promotions were effective and added value versus which were not.

TPO tools use advanced analytics (often based on artificial intelligence techniques) to exploit a range of internal and external data sets and provide predictive and prescriptive insights. These provide the capability to look forward, perform ‘what if?’ scenario analysis, predict which promotions are likely to be effective, and recommend what action to take as a result.

NRM provides organizations with the ability to effectively exploit the data available to them, identifying and leveraging opportunities for good growth – or, more precisely, net revenue growth. A number of CPG organizations are choosing to either buy or build tooling that automates some or all of the complicated calculations required to develop accurate NRM insights.

A simplified view of the overall data and technology landscape that most CPGs are driving towards

Trade promotions management systems

Recognizing the importance and complexity of promotion planning, execution and monitoring, CPG organizations are increasingly looking to digitize these processes, moving away from bespoke Microsoft Excel models and towards workflow-based tooling.

CPGs are looking for these tools to enable sophisticated analytics offering real actionable insights, including sales forecasting, post event analysis and – ultimately – predictive and prescriptive trade promotions optimization (powered by artificial intelligence techniques including machine learning).

They are also looking to drive process efficiency through increased automation (including robotics process automation) and/or offshoring – whether insourced or outsourced – to exploit wage arbitrage opportunities.

There are a number of suppliers offering these types of TPM tooling solutions, from industry giants such as SAP and Accenture through to smaller, entrepreneurial organizations such as Anaplan and VisualFabriq.

However, regardless of the supplier they select, CPG firms have often found these tools very expensive and difficult to implement.

The common industry theme seems to be that these TPM implementations are amongst the most challenging (and most often failing) programs that they attempt.”

This begs the question – why? In our experience there are a range of key challenges, including:

Sales is a ‘front office’ function, on the front line of the customer interface. This can lead to an inherent conflict between creating a great customer experience (by adapting to the way your customers want to work) and driving regional or global standardization.

There are also real differences between markets – there are international standards for finance but not for sales!

Given this, our experience shows that there is no ‘one size fits all’ approach for TPM systems - some customer, legal or fiscal variations will be unavoidable by market. In fact, some CPG organizations that we have worked with have, despite best efforts to standardize, seen the local variation against a global set of requirements at up to 30%.

To some extent, this depends on the culture of the organization – a strong ‘command and control’ structure with centralized management may have disadvantages in other respects, but it makes it easier to drive standardization than an organization with a culture of market autonomy and devolved decision making.

CPG organizations must ensure that:

a) the costs associated with anticipated local variations are costed into any business case before global investment decisions are taken, and

b) a strong empowered global design authority is set up to ensure that any requests for local variation are managed effectively across markets.

At minimum TPM systems require integration with Enterprise Resource Planning (ERP) and supply chain planning systems. Building and then managing the interfaces with these systems drives substantive and ongoing costs that must be factored into any business case before global investment decisions are taken.

To be effective, TPM systems rely on good quality, trusted data. Data quality must be validated before any new TPM system is implemented and, if required, any costs to improve upstream data quality must be factored into the global business case.

Given these facts, it would be beneficial for organizations looking to invest in new TPM technologies to review and potentially refresh their broader IT and data strategies.

Net Revenue Management

Many CPG organizations are already exploring how analytics tooling can support strategic decision making. One use case is the automation of NRM calculations, fed directly from ERP systems and market share information providers. The ability to automate the highly detailed analysis required to develop meaningful NRM insights is a true ‘force multiplier’ for CPG organizations.

However, there are some constraints that should give decision makers pause for thought before they make the decision to invest in tooling, including:

- The challenge of making any tooling cost effective given the complexity of the CPG product hierarchies, and

- The availability of the good quality market share data needed to make the analysis credible.

For more detailed insights on Net Revenue Management and related tooling please see our previous article ‘Secure Good Growth with Net Revenue Management’.

Exploiting data to create actionable insights

The implementation of standardized TPM software provides the data standardization rigor required to merge TPM information with data from other internal and external sources. There are several ways that this data can be exploited to create actionable insights.

POST EVENT ANALYSIS

PEA tooling automates the process of assessing the effectiveness of promotions against plan, allowing organizations to continually improve their promotion strategies. This capability can already be purchased off the shelf, either as an integral part of some TPM products or as a stand-alone module.

As these tools are ‘tried and tested’ some organizations may feel more comfortable in investing here than in newer, more sophisticated tooling, such as those products that claim to deliver trade promotions optimization (TPO) capabilities.

TRADE PROMOTION OPTIMIzATION

TPO tooling is being marketed as a capability that can be used to exploit a range of different datasets and the latest Artificial Intelligence technologies to deliver predictive and prescriptive analysis. There is no doubt that these tools can provide CPG organizations with a competitive edge...

But watch out for...

New technology

The technology is relatively new so there is not currently a wide selection of ‘off the shelf’ products available.

Building rather than buying these tools is likely to be costly both in implementation and in order to fund ongoing maintenance and upgrades.

New datasets

Introducing new datasets makes effectively structuring and merging data even more complex – a challenge that CPGs with diverse product portfolios already face.

‘Proof of concept’ projects may deliver impressive results but may also be based on an unsustainable level of manual data preparation.

High quality data

Reliance on high quality data means that organizations will need to invest in foundational TPM systems that provide the required data labelling.

Micro or macro

The organization needs to decide whether to focus on ‘micro TPO’ – specific use cases such as individual promotions, customers, categories, etc. – or ‘macro TPO’ – looking for big picture trends and opportunities across the whole market.

But watch out for...

New technology

The technology is relatively new so there is not currently a wide selection of ‘off the shelf’ products available.

Building rather than buying these tools is likely to be costly both in implementation and in order to fund ongoing maintenance and upgrades.

New datasets

Introducing new datasets makes effectively structuring and merging data even more complex – a challenge that CPGs with diverse product portfolios already face.

‘Proof of concept’ projects may deliver impressive results but may also be based on an unsustainable level of manual data preparation.

High quality data

Reliance on high quality data means that organizations will need to invest in foundational TPM systems that provide the required data labelling.

Micro or macro

The organization needs to decide whether to focus on ‘micro TPO’ – specific use cases such as individual promotions, customers, categories, etc. – or ‘macro TPO’ – looking for big picture trends and opportunities across the whole market.

Deepening customer relationships

CPG organizations can use TPM systems and associated analytics tooling to change the conversation with their customers, in some cases driving a more collaborative approach to customer business planning and even, in other cases, enabling joint business planning.

Current approaches to annual negotiations often use the prior year plan as an initial negotiating position. For customers this approach can provide an opportunity for them to push historical promotion strategies, even though these might be not be optimized for the CPG organization and ultimately the customer themselves. Through investing in advanced analytics CPGs can bring more sophisticated ‘zero based’ strategies (i.e. start afresh, not from last year’s plan) to the negotiating table, ultimately driving better returns for all parties.

True ‘joint business planning’ relies on both parties sharing high quality KPI and sales information. This information sharing builds the level of trust required to change annual negotiations from oppositional to collaborative. The rigor and data labelling achieved through implementing TPM systems is a key enabler for achieving this.

The importance of effective change management

The level of business change required to successfully implement TPM and associated analytics products is substantial. Many salespeople will not have the experience or skills required to effectively use analytics tools to support their decision making.”

Many organizations primarily incentivize their sales staff based on sales growth. The insights provided by the tooling and approaches described here can lead to a more sophisticated set of incentives for sales people, for example including profitability and trade spend optimization targets.

These are significant changes for many salespeople, especially when considered with the enhanced process rigor and databased decision making that come with the introduction of a new TPM system that salespeople may see as restrictive or going against their experience and ‘gut feel’. To be successful, CPG organizations need to invest in a comprehensive change management approach and the resources required to deliver it (for more information on effective change management see our article ‘Business change in an agile world’)

How can Berkeley help?

Organizations need to embrace substantial change to take advantage of the capabilities provided by TPM and associated analytics tooling. At Berkeley we have a wealth of experience helping clients to successfully define their strategies and/or deliver the transformation needed to implement exactly this type of complex change.